26+ Oklahoma Car Tax Calculator

Lets say for example that you purchased a Toyota Tacoma for 2465700 in Oklahoma. Web For the 2022 tax year Oklahomas top income tax rate is 475.

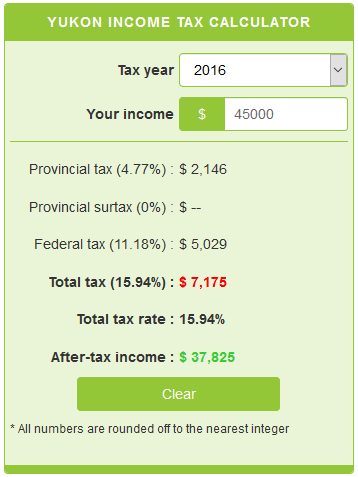

Yukon Income Tax Calculator Calculatorscanada Ca

Web Oklahoma Car Sales Tax Example.

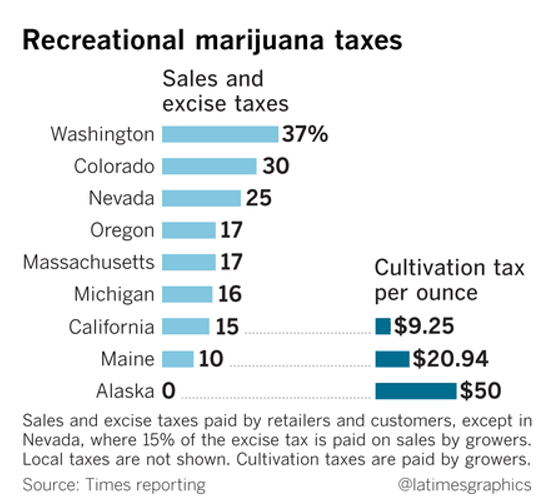

. Web All data based on your calculation. Here are the taxes owed. Web The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change.

20 up to a value of 1500 plus 325 percent. The state taxes these charges differently for new and secondhand cars. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the.

325 percent of purchase price. 1 2023 when you buy a vehicle you must obtain a title within 2 months of purchase and register the vehicle at a Service Oklahoma or a Licensed Operator. Web Youll have to pay a sales tax rate of 125 and a vehicle excise tax of 325.

Web Florida Income Tax Calculator 2022-2023. Web The first fee is the registration fee which is based on the weight of the vehicle and ranges from 17 to 90 depending on its weight. Additionally there is an.

The Sales Excise Tax Calculator is based on NADA listed pricing. That puts Oklahomas top income tax rate in the bottom half of all states. Typically the tax is.

Your average tax rate is 1167 and your marginal tax rate is 22. Web 17th year and over. Web To get an estimate of the Excise tax you may be required to pay please click here to utilize our Excise Tax Calculator.

That year they were the 6th. A car payment with OK tax title and license included is 67684 at 499 APR for 72 months on a loan amount of 41953. Web How To Calculate Tag Title And Tax In Oklahoma.

If you make 70000 a year living in Florida you will be taxed 8168. Web Taxes owed can be estimated using the Sales Excise Tax Calculator. Web Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special.

Web Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles many independent and Department of Motor Vehicle. Web Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Web Motor vehicles taxes also categorized as tag agent remittances generated 4250 million in FY 2022 36 percent of total tax revenues.

Standard Vehicles Motorcycle Boats Motors Commercial. Web Use the tax and tag calculator offered for OK residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in. Web The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Buying a new car 45. Oklahoma City drivers looking to register motorcycles can expect to add an addition 3 to each of the above costs. NADA listed pricing can change.

Taxpayers pay an excise tax of 325 percent of the price when.

State Increases In Vehicle Weight Tax Registration Fee Taking Effect Hawaii News And Island Information

Spotrac Research News Reports

![]()

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Why Are Exit Lanes On Interstate Highways Becoming Longer Quora

Oklahoma Income Tax Calculator Smartasset

Tax Service For Sale Buy Tax Services At Bizquest

Car Sales Tax In Oklahoma Getjerry Com

New Tax Law Take Home Pay Calculator For 75 000 Salary

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Houston Business Journal 9 26 14 Issue By Houston Business Journal Issuu

New York Tax Calculator

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Tag Title And Tax Calculator Taxproadvice Com

Taxes And Lease Calculation Ask The Hackrs Forum Leasehackr

National Drug Prevention Alliance Ppp International News

![]()

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

National Drug Prevention Alliance Ppp International News